About

DarkTrend is a data analysis service that reveals the hidden individual price trends of financial instruments by filtering out the “noise” from broader market and sector movements.

DarkTrend Screener & Explorer

Built around a combination of three core principles:

- Hidden trends: We extract hidden trends (which we term “dark trends,” similar to dark matter) from financial time series such as stocks, ETFs, and currencies. This is achieved by filtering out correlations with other series, considering them as “noise.”

- Unique metrics: Our screener selects assets particularly well-suited for effective hidden (dark) trend analysis, based on practical tradability (via our proprietary liquidity metrics).

- Rapid Visual Analysis: Quickly scroll through charts to identify investment opportunities with ease and efficiency

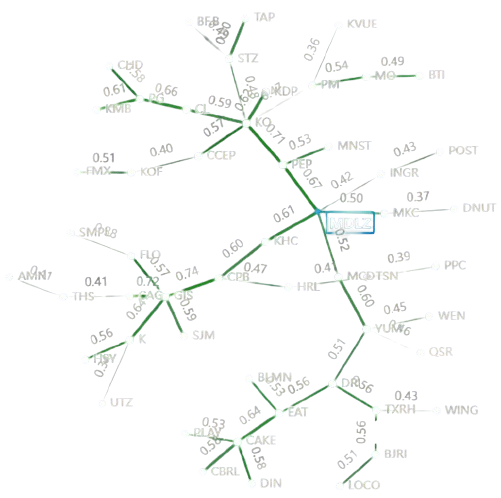

CorrGrid Correlations & Market Topology

CorrGrid Correlations & Market Topology allows users to dive deep into the structure of financial instrument correlations and market topology.

CorrGrid Correlations and Cointegrations identify promising pairs/groups for specific trading strategies (pair trading, mean-reversion, stat arb), while CorrGrid Market Topology uses methods like minimal spanning trees (MSTs) to visualize complex interdependencies.

This assists in discovering investment opportunities, engaging in pair/correlation trading, hedging, and reducing risk.

The content and materials provided are not intended as, and should not be taken as, financial, investment, trading, or any other form of advice, nor as recommendations that have been confirmed or supported by DarkTrend or its affiliates. For more details, please refer to the Terms of Use